[expand title=”The Granite Advantage”]

While our competition is tied to one bank or insurance agent, GPF is completely independent of any bank or insurance agency. GPF has developed relationships with several banking entities to create an infrastructure of mobility. This allows GPF to find unique financing solutions to the challenges that face the independent agent. Through our network of banking relationships, GPF has the flexibility to find unique solutions to your outside-the-box issues. Our banks compete for your business to ensure you and your clients get the lowest down payments and rates. We do the legwork while you get all the benefits. Because of our model, we guarantee our service and solutions are the best in the industry. In addition, we are a privately held entity that has no affiliation with your competition. We work for you and do not contribute to the bottom-line of your competition.

[/expand]

[expand title=”What is Premium Finance?”]

Premium Finance involves the lending of funds to a person or company to cover the cost of an annual insurance premium. Granite Premium Funding provides premium finance loans.

To finance a premium, the individual or company requesting insurance must sign a premium finance agreement with Granite Premium Funding. The loan arrangement may last from one year to the life of the policy. GPF then pays the insurance premium and bills the individual for company, usually in monthly installments, for the cost of the loan.

[/expand]

[expand title=”How does it work with GPF?”]

Premium Finance involves the lending of funds to a person or company to cover the cost of an annual insurance premium. Granite Premium Funding provides premium finance loans.

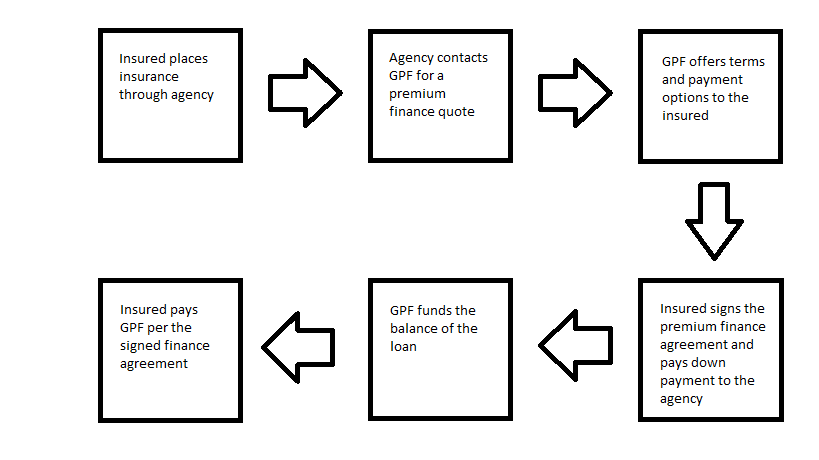

To finance a premium, the individual or company requesting insurance must sign a premium finance agreement with Granite Premium Funding. The loan arrangement may last from one year to the life of the policy. GPF then pays the insurance premium and bills the individual for company, usually in monthly installments, for the cost of the loan. An insurance agent partners with GPF via a producer agreement. GPF creates a customized program for the insurance agency. GPF offers the agreed upon program to the agents insured’s to pay for the insured’s insurance policy via a “premium finance agreement.” By virtue of the signed agreement, the insured pays a down payment and GPF funds the balance, or amount financed, to the agent or broker. The insured will receive an installment loan from GPF per the loan agreement to pay back over time; usually one year. The return premium from the insured’s policy acts as collateral making the process quick and easy.

[/expand]

[expand title=”Flow Chart of the Premium Finance Process:”]

[/expand]

[expand title=”Sample Financing Solutions”]

Granite Premium Funding offers flexible premium financing programs with benefits for both agents and insureds.

Sample terms might be:

- 25% down and 10 monthly payments

- 15% down and 10 monthly payments

- 10% down and 9 monthly installments

- 25% down and 3 quarterly installments

- 33% down and 1 annual installment for multi-year policies

We have several flexible payment options depending on the insured’s financial stability and insurance policy type.

[/expand]